|

Enroll Now

|

DATA BREACH NOTICE: If you believe your LMFCU Credit or Debit Card has

been compromised.!

Limited time offer - apply today! Click the "Apply for a Loan" button on the left side of this page to print a loan application.

|

Virtual Branch -- Sign-Up

Virtual Branch, the internet home banking service of the Louisville Medical Federal Credit Union is now available for all members. If you have not previously used Virtual Branch, you can click the "Enroll Now" button (above left) and self-enroll. You will need your Credit Union Account Number, last 4 digits of your Social Security Number, your complete Social Security Number (no dashes), and your address number. Once enrolled, you'll be able to see your current balances, transfer funds from one account type to another, and view transactions.

e-Statements in Virtual Branch

You can sign-up for electronic statements under the "Self-Service" tab - in the "Additional Services" box. e-Statements are available in PDF format and can be viewed for 6 months. You can also print your statements and save statements to you own computer.

Cancelled Checks Now Available in Virtual Branch

If you have a checking account with us, Virtual Branch now allows you to view checks which have cleared your account. Just click on the red check number in your account history and you'll be able to view the front and back of checks you wrote on your account with us.

If you have a checking account with us and are also interested in using PayIT, our Bill Pay service, please call us at 502-629-3716 to have this service added.

|

Work in Healthcare? We are YOUR Credit Union!

Members of your immediate family are also eligible to join. And,

if you've been employed at least one year, you're immediately eligible to apply for a loan or

VISA Rewards credit card account. CLICK HERE to print your own enrollment forms.

The Louisville Medical Federal Credit Union is the only local federally insured

Credit Union chartered to serve employees of healthcare organizations exclusively!

Have you been denied a checking account? Our Second Chance Checking Account Can Help!

You can open a Second Chance Checking Account with Direct Deposit, Debit/ATM Card Access and Low

Monthly Fees. Maintain the account in a satisfactory manner for six (6) months and you can request to

convert it to a regular checking account. Call us at 502.629.3716 for all the details.

|

|

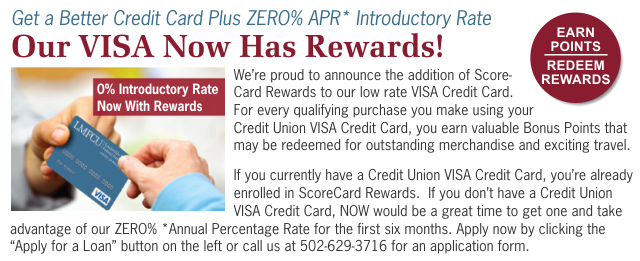

ZERO% APR On Balance Transfers of at least $1,000 from another Credit Card to your Credit Union VISA Card

Personal finance expert Susie Orman recently said, "Credit Unions are being more responsible to their members than banks." Consumers with credit cards might want to think about doing a balance transfer to a Credit Union.

Source: MSNBC's "Morning Joe" program from October 9, 2009

|

Look for this logo

at all participating Shared Branch locations |

Shared Branch Service Center Locations

Members of the Louisville Medical Center Federal Credit Union can now access accounts at more than 4,100 Shared Branch locations across the country. Use of the Shared Branch network is free -- you must have your account number and a valid photo ID.

East End Service Center: 2925 Goose Creek Road (near Westport Road)

Phone: 502-429-0068

South End Service Center: 4917 Dixie Highway (Sears Shoopping Plaza)

Phone: 502-448-1686

Hours: Monday - Friday: 9:00 a.m. -- 7:00 p.m. and Saturday: 9:00 a.m. -- 2:00 p.m.

Both locations have a Drive-Thru and a 24 hour ATM

|

|

DirectPaydayLoans

|

Applicants can apply for up to $20,000 in cash loans. The company has nearly 1,500 locations in over 44 states. Customers may access personal direct loans or payday loans by phone. Terms vary between 24 and 60 months, at an APR range between 18% and 35.99%.

Phone: (800) 742-5465

Office hours: Monday-Friday 7:00 AM to 7:00 PM

|

|

1F Cash Advance

|

Payday loans of up to $5,000 are available to all eligible applicants. Repayment terms range from one month to several months.

The company specializes in same day loans. Borrowers may receive a cash advance or a payday installment loan within 24 hours. The interest rate is a flat fee between $10 and $30 for every $100 borrowed.

Online applications: open 24/7

|

|

Abattis Loans

|

As a customer, you will need an active account to borrow funds repeatedly as needed. At the end of each month, the company will issue you a monthly bill for your line of credit. Borrowers that qualify can also apply for payday loans from $100 to $1,500. Installment loans with repayment terms from 6 to 12 months are available in certain states. The company checks an applicant`s credit ratings before approving a loan.

Office hours: Monday-Friday: 8:00 AM to 9:00 PM, and Saturday: 10:00 AM to 5:00 PM

|

|

You Can Fight

Identity Theft

|

How to Fight Identity Theft . . .

-

Never provide your personal financial information, including your Social Security Number, account numbers or passwords in response to an unsolicited request over the phone or internet, if you did not initiate the contact.

-

Never click on the link in an e-mail you think is fraudulent.

-

Review account statements regularly for accuracy.

-

If you fall victim to identity theft, act immediately to protect yourself.

For Additional Information Click IDENTITY THEFT HERE!

|

|

15M Finance

|

-

Promoting of Responsible Borrowing

-

Trustful Connecting Company

-

Reliable Network of Direct Lenders

-

Fast and Equitable Approval Process

-

No Hard Credit Check

-

Customer Care Support 24/24

For more details, contact the website.!

|

|

|

|

Got a Question or Want to Tell Us What You Think . . .

If you have a comment or a suggestion, a compliment, even a complaint, we'd like you to tell us what you think about your Credit Union. Just click on this e-mail link and let us know: [email protected].

Thank You!

|

TO REPORT FRAUD OR LOST / STOLEN CARDS

To report fraud or a lost/stolen Credit Union VISA Credit Card, call 1-800-991-4964.

To report fraud or a lost/stolen Credit Union ATM or DEBIT card, call 1-800-472-3272.

|

© 2014 • LOUISVILLE MEDICAL FEDERAL CREDIT UNION

234 East Gray Street, Suite 130 • Louisville, Kentucky 40202-1907

|

| Main Office Hours |

| |

|

|

| |

Monday |

7:30 a.m. to 4:00 p.m. |

| |

Tuesday |

8:00 a.m. to 4:00 p.m. |

| |

Wednesday |

10:00 a.m. to 4:00 p.m. |

| |

Thursday |

8:00 a.m. to 4:00 p.m. |

| |

Friday |

8:00 a.m. to 5:00 p.m. |

| |

| |

The Louisville Medical Federal Credit Union is closed on all Federal Reserve Bank legal holidays and the Friday after Thanksgiving. |

|

Accuracy

Though we strive for accuracy, occasionally, the information at LMedFCU.org may contain typographical errors, inaccuracies, or omissions

in relation to product descriptions, pricing and availability. We apologize for such oversights. We reserve the right to correct any errors,

inaccuracies or omissions and to change or update information at any time without prior notice.

|